how much does the uk raise in taxes

Tax receipts in the UK 2000-2022. The UK has one of the more progressive.

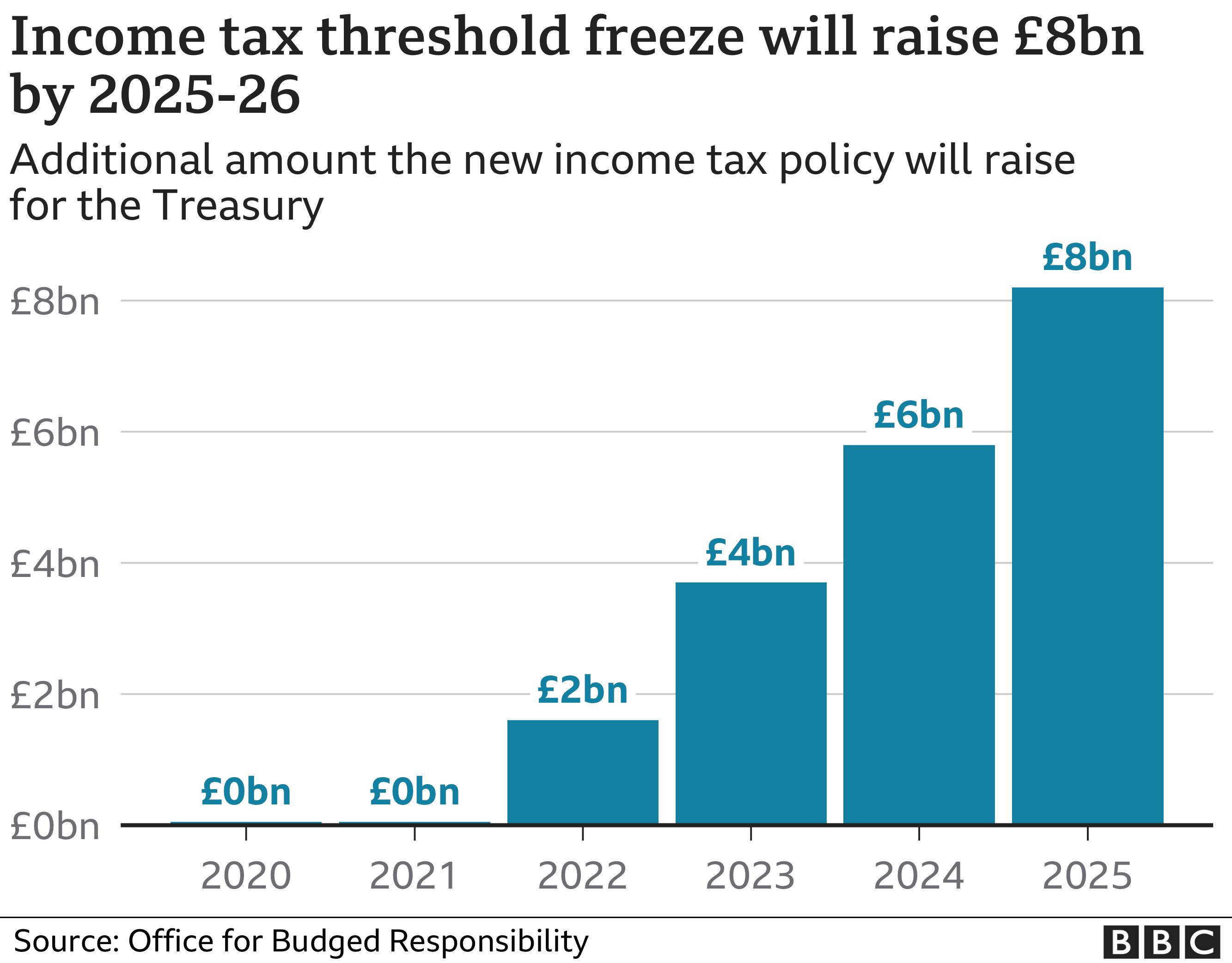

Budget 2021 Million More Set To Pay Income Tax By 2026 Bbc News

That meant the government went back on its 2019 election manifesto promise not to raise the tax.

. In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds. UK tax revenues were equivalent to 33 of GDP in 2019. How much does the UK raise in tax compared to other countries.

For example income tax is. 3 minute read September 3 2021 859 AM UTC Last Updated ago Britain set to raise taxes to pay for social care - reports. Home does raise taxes uk.

Tax revenues as a percentage of GDP for the UK in comparison to the OECD and the EU 15. This was true in 2010 and is forecast to be true in five years time. That would be an extra 91000 in tax revenue per person.

The so-called additional rate of income tax of 50 for incomes over 150000 pounds 16839000 a year was introduced in April 2010 by the government of former prime minister Gordon Brown from the centre-left Labour Party. How much does the UK government spend each year. One of the EU15 countries that raise more tax than the UK.

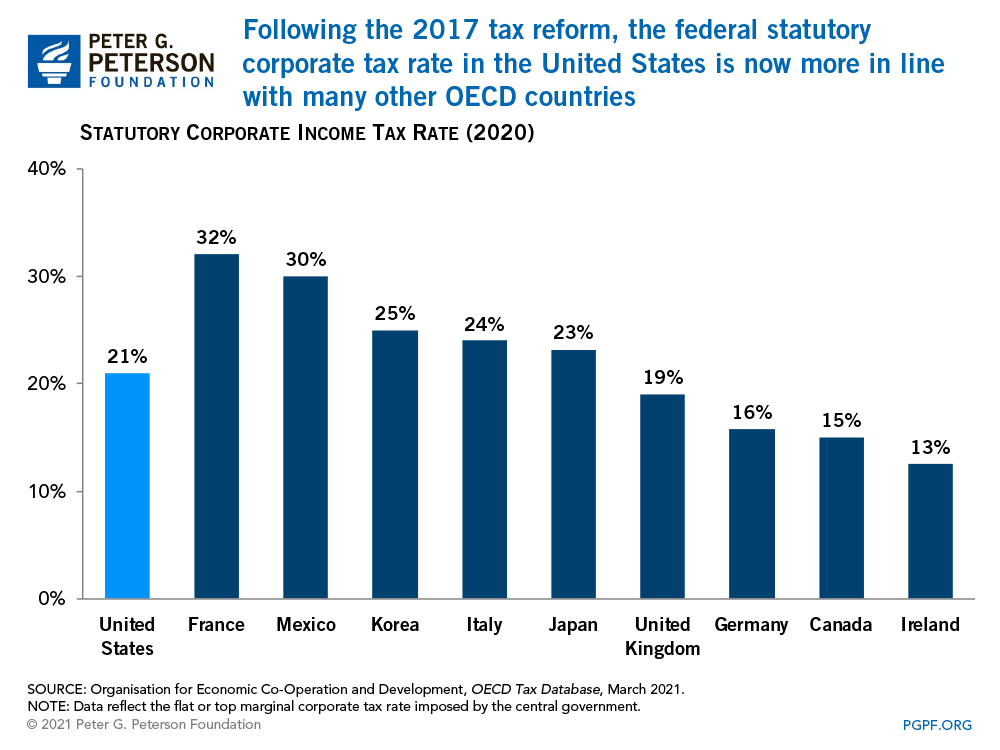

Pa Unemployment Base Year Chart Sales Taxes In The United States 350. In 202122 total UK government revenue is forecast to be 819 billion or. Under the previous governments plans the rate of Corporation Tax was to increase from 19 to 25 from April 2023 for firms making more than 250000 profit around.

Government expenditure as a percentage of GDP in the United Kingdom was at 354 in. What about the corporation tax increase. This represents 247 per cent of all receipts and is equivalent to 7600 per household and 92 per cent of.

In 1971 the top rate of income tax on earned income was cut to 75. A surcharge of 15 on. This is slightly below the average for both the OECD.

How Much Income Tax do People Pay. In 202122 corporation tax receipts in the United Kingdom amounted to approximately 67 billion British pounds an increase of around 146 billion pounds when. The Conservative-led government of David Cameron cut the rate to 45 from April 2013.

There was an 8 billion increase in revenues from additional rate taxpayers after the top rate of tax was reduced from 50p to 45p. UK Income tax is based on marginal tax rates. UK Government Expenditure Statistics.

Companies with profits between 50000 and 250000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective Corporation Tax. How much does the uk raise in taxes Wednesday March 16 2022 Edit. The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system.

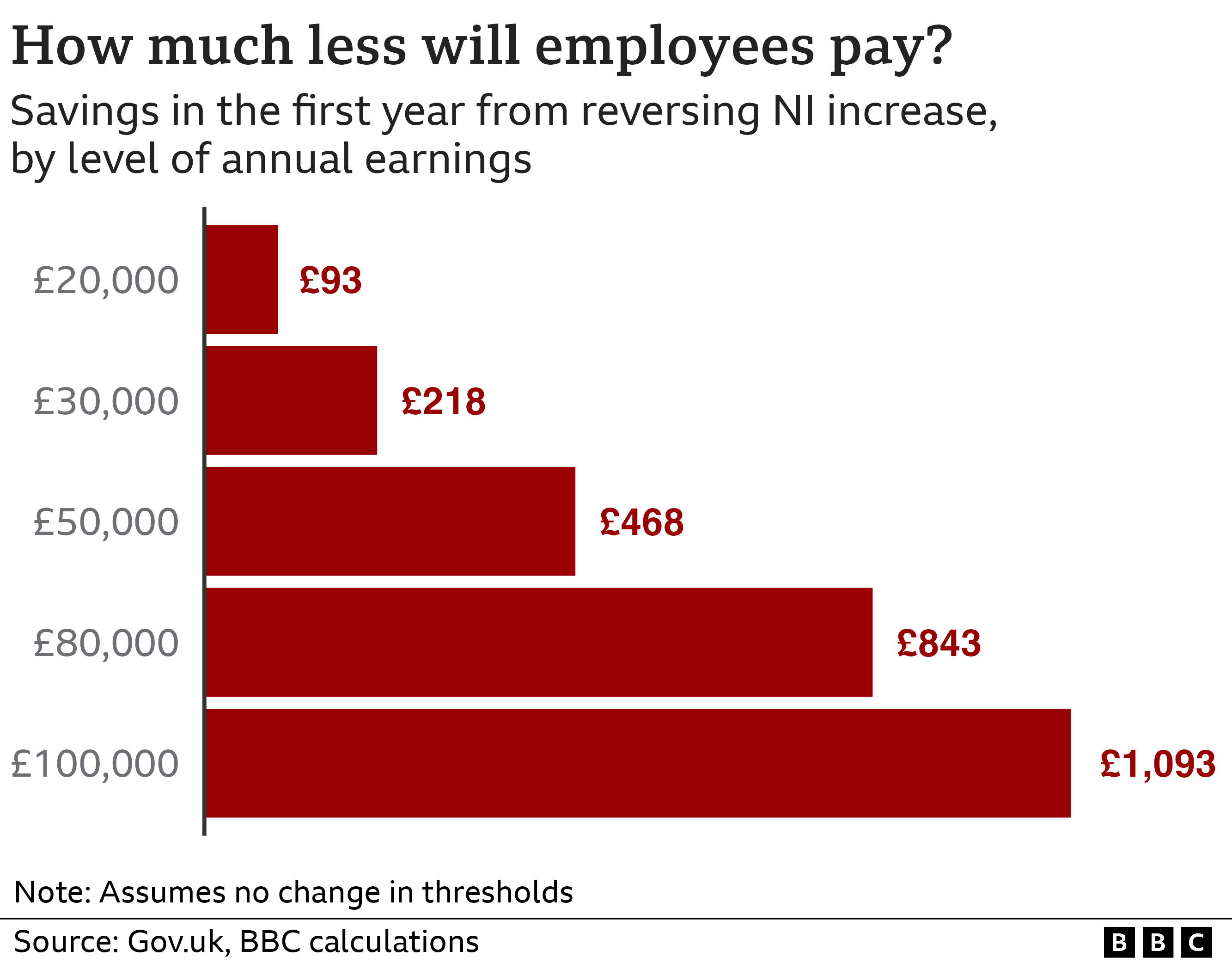

In 2021-22 we estimate that income tax will raise 2132 billion. Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m. 4 March 2016.

The UK is more of an outlier at the median especially for SSCs than it is for top earners. Former chancellor Rishi Sunak set out plans in his 2021 Budget for corporation tax to rise from 19 per cent rate to 25 per cent in 2023. The NI increase was due to be replaced by a new Health and Social Care Levy -.

The table below is a useful guide to how much income tax you. But this relative stability masks important changes in the composition of revenues.

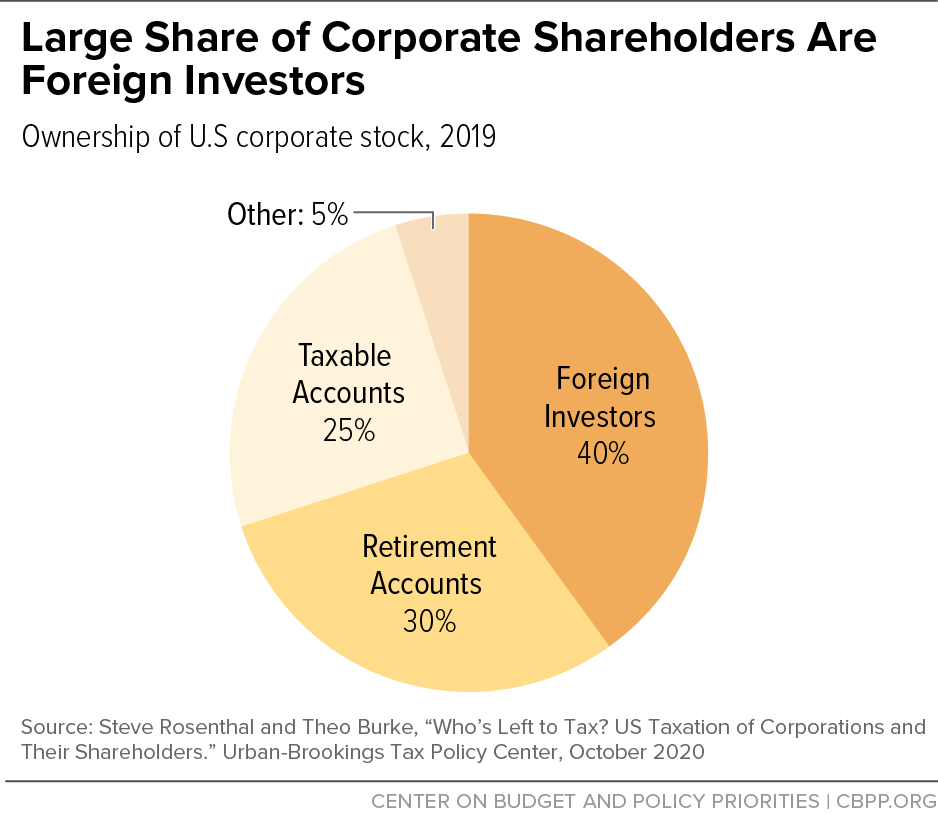

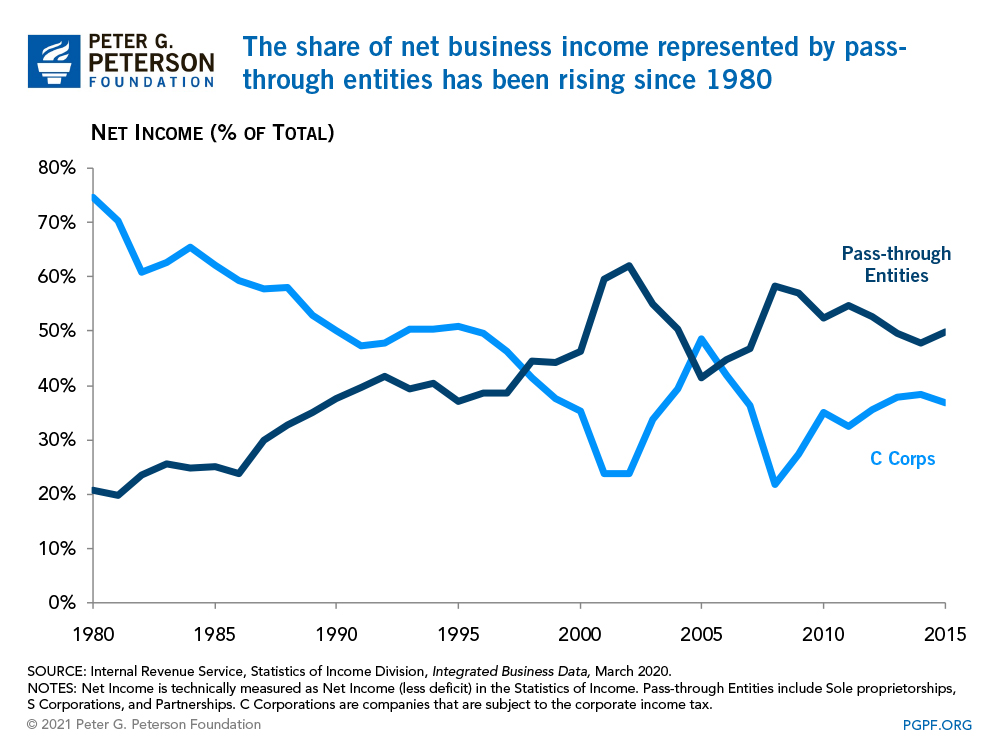

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

Tax Statistics An Overview House Of Commons Library

Does Cutting Corporation Tax Always Raise More Money Bbc News

National Insurance Will Tax Cut Save Me Money Bbc News

Tax On Test Do Britons Pay More Than Most Tax The Guardian

Institute For Fiscal Studies On Twitter The Uk Has Lower Average Tax Rates On Middle And High Income Earners An Employee On Median Income About 28 000 Faces An Average Tax Rate

Taxation In The United Kingdom Wikipedia

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

How Do Us Taxes Compare Internationally Tax Policy Center

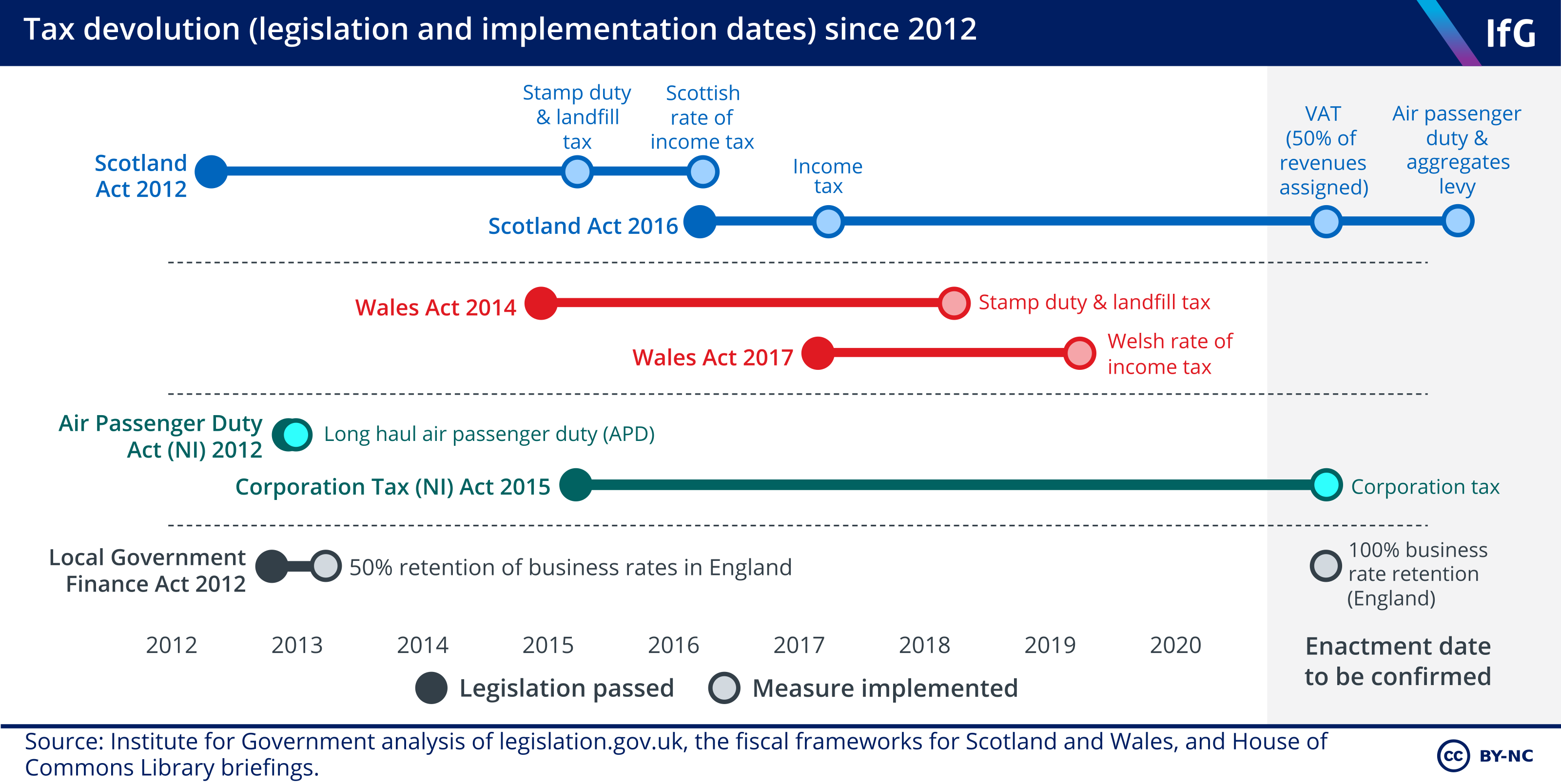

Tax And Devolution The Institute For Government

How Do Marginal Income Tax Rates Work And What If We Increased Them

Sources Of Us Tax Revenue By Tax Type Tax Foundation

Chart That Tells A Story Income Tax Rates Financial Times

The Effect Of Tax Cuts On Economic Growth And Revenue Economics Help

Uk Imposes 25 Energy Windfall Tax To Help Households As Bills Surge Reuters

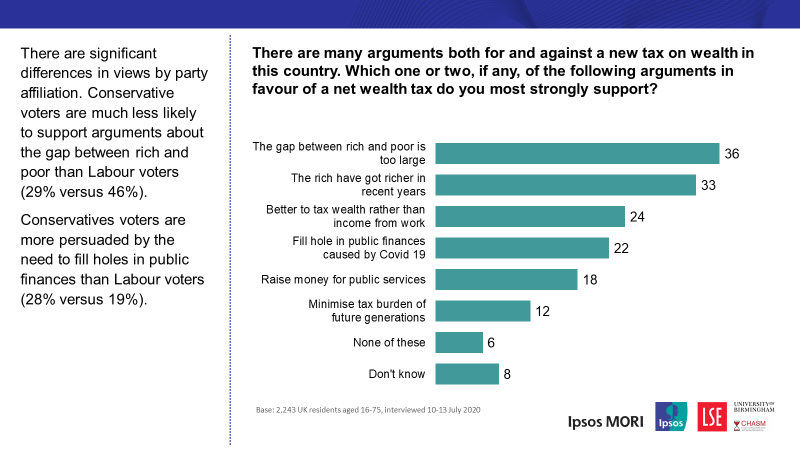

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

:max_bytes(150000):strip_icc()/GettyImages-1136346827-3eba69ab996a4abeb0836afe62abfd3c.jpg)